Get an Instant Pre-qualification Certificate in 60 Seconds!

Although this is not a full pre-approval, our Instant Pre-Qualification Certificate will give you an estimated purchase price based upon your income and credit score!

Although this is not a full pre-approval, our Instant Pre-Qualification Certificate will give you an estimated purchase price based upon your income and credit score!

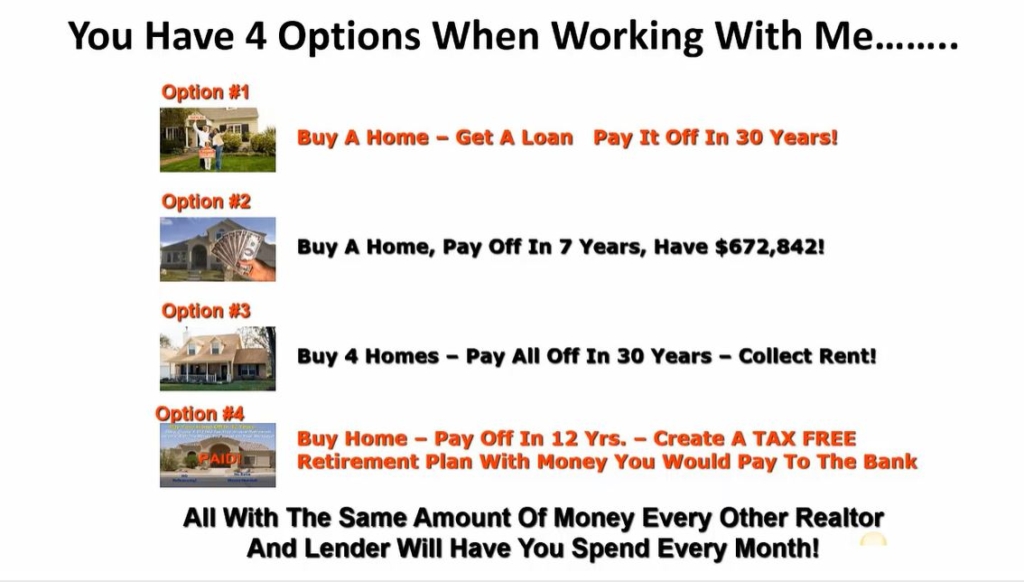

Using creative financing strategies, Buyers can SAVE Hundreds-of-Thousands of Dollars on mortgage interest, through this exclusive, custom-made financial services plan for Homeowners offered by the Widerberg Group.

Investors who purchase 25+ properties annually can get access to the eXpress offers platform. Through eXp’s in-house I-Buyer software, nearly 85,000+ agents will send them off-market properties with little competition.

,

What if you had a team of 85,000 Realtors sending you exclusive OFF-MARKET Opportunities in ALL 50 States? Wouldn’t that make your investment search MORE efficient & MORE profitable?

What if you could join our network for FREE?

My listings average 30 offers and 126% of my listing price using the Online Offers Listing Method!

What if you had access to FREE Real Estate Attorney Services for Sellers in Illinois?

Buying properties listed on non-blind online offers websites is the most transparent way possible to purchase real estate!

Our traditional Buyer services are anything but ordinary.

Included for All Buyers:

Automated Listing Searches

On Demand Showing Requests

My Equity Blueprint Enrollment

Our Portfolio of Mortgage Services

Full-Service Hand-Holding Throughout the Purchase

Are you concerned you won’t be able to find a lender who can give you access to the BEST RATES in the industry with the MOST unique loan products available? Are you worried your credit score may be too low to qualify? We’ve got you covered:

Are you concerned the interest rates are too expensive to purchase Real Estate?

What if there was a way to find new listings with existing FHA or VA interest rates below 3%? If you could take over their loan, wouldn’t that potentially save you hundreds of thousands of dollars in interest and lower your monthly mortgage payment dramatically?

I happen to have a list of low-interest rate properties with existing Assumable Mortgages!

I’m Ryan Widerberg, a licensed real estate broker and founder of the Widerberg Group at eXp Realty. If you’re thinking about buying or selling real estate, you’ve come to the right place. I’ve closed on hundreds of real estate transactions and would be honored to help guide you through the process. Please contact me at 1.847.849.7748 or email me at ryan.widerberg@exprealty.

Why Use Me as Your Buyer’s Agent: Choosing a Buyer’s agent can seem like a daunting task. As an accredited Buyer’s Representative (ABR), I promise to send you listings that fit your criteria. If you would like to alter your search parameters in any way, please let me know. While I have the ability to filter your search results in a variety of ways, I usually filter with the least amount of parameters possible, with number of beds and baths, price range, garage spaces, age of the property, school district, lot size, whether a listing has a basement and communities you’re interested in moving to as being the most common. Because many listing agents don’t completely fill out all of the property’s information in their listings, a number of parameters remain untrustworthy to search by, including square footage, laundry availability, whether a property includes a fence, and several others, so I recommend using as few search parameters as possible and cherry picking through listings, otherwise your search might be over-filtered, and you may otherwise miss out on a substantial amount of qualified properties.

I will only email you new listings once, so it’s important to review my emails regularly. I will make sure you receive the newest listings daily. If you don’t receive daily emails, it’s because there are no new listings that meet your search criteria. In that event, it may be a good idea to expand your search criteria to additional areas, increase your price, or alter various other search criteria.

As your agent, I have a multi-faceted job and commit to serving you to the best of my ability. I’ll make sure to show you the listings you’re interested in promptly and will guide you through the offer process as smoothly as possible. I’ve been working with Buyers for well over a decade and have acquired a range of useful tips and tricks to ensure your offer will be taken seriously for consideration in competitive Seller markets and to ensure you get the best deal possible, with maximum Seller concessions in less competitive Buyer’s markets.

Over hundreds of real estate transactions, I’ve mastered the art of negotiation. I know what Buyer terms will make your offer the most attractive when we have heightened competition and what we might be entitled to ask for when we’ve got the upper hand in a negotiation.

As a leading professional in my industry, I work with a variety of contractors and have a professional I can recommend for any job.

Why Sign an Exclusive Buyer Agency Agreement – With new technologies driving Buyers to different real estate websites and Buyer data ending up in inboxes of dozens of different realtors as leads, it’s no wonder there’s confusion as to which realtor a Buyer is working with or who they should remain loyal to. Is it the realtor who’s already spent countless weekends meeting a Buyer at showings or the real estate agent they met on their own at the open house? Perhaps their loyalty remains with the newest realtor who ends up showing the Buyer a property they decide to make an offer on.

While many Homebuyers prefer to stay loyal to the first competent agent they meet, especially one willing to work long hours, during their Buyer’s preferred schedule, this isn’t always the case. The alternative is working with several realtors, all of which will call, text, and email you listing options. Most Buyers prefer not to be bombarded by messages from every realtor they meet. This is one of many reasons it’s important to sign an Exclusive Buyer Agency Agreement with the realtor you intend on doing business with. An Exclusive Buyer Agency Agreement is a legal, bilateral agreement that spells out the expectations for both the Buyer’s agent and Buyer, ensuring your best interests throughout the process, and protecting both Buyer and realtor while working toward their common goal of navigating through the home buying process.

This protects the agent from investing a lot of time and effort before the Buyer ultimately decides to work with another agent. It also places a legal requirement for the agent to serve their best interests at all times. And from a legal perspective, signing an agency agreement means everything that a Buyer shares with their agent is kept in confidence and cannot be shared with the Seller or another party unless permission is granted. Finally, it stipulates that an agent is legally required to negotiate in the Buyer’s favor, with no regard to the Seller’s benefit. Without a Buyer’s Agency Agreement, Buyers are considered customers and not clients, therefore, realtors do not have a legal obligation to negotiate on your behalf or warn you of possible red flags. With an agreement, Realtors are required to:

Upon signing an agreement, you’ll have many other benefits. When an agent sees that you’re making a commitment to them, they’re more likely to spend more time proactively working on your behalf: setting appointments, explaining paperwork, working closely with lenders, ensuring you do not miss the many deadlines, and much more.

How to Get Financed: Your first step to becoming a homeowner is to contact a mortgage professional and obtain a pre-qualification. While many Buyers go to their banks or credit unions, I recommend finding a Mortgage Loan Originator (MLO) to help you get pre-qualified instead. While most mortgage brokers at banks only work Monday-Friday banking hours, MLOs work seven days a week and can often send you a same-day pre-qualification. Nothing’s worse than seeing a property on a Friday evening and having to wait until Tuesday or Wednesday to obtain a pre-qualification in order to make an offer. In competitive Seller markets, your dream property might go under contract while you’re waiting for your proof of financing, so it’s best to begin your home search fully prepared. Not only will you have a better idea of what you can afford and what your monthly payments will be, but it’ll give you the peace of mind of knowing the property you’re interested in won’t slip away.

When it comes to filling out your mortgage application, you will have to compile several documents including the last two years of your tax returns, pay stubs from the last few months, W-2s, or other proof of income such as child support or social security, several months of past bank statements to ensure you have enough for your down payment, balances of any investment assets you have, gift letters for down payment funds from family members, drivers license and sometimes even 12 months of rent check or mortgage payments. My preferred lender can help Buyers close in as little as 10 days, which is a huge advantage during a competitive Seller’s market. Please see his information in the description below.

While your mortgage broker or MLO will make a hard pull against your credit, it shouldn’t affect your credit score by more than a few points, so applying for a mortgage is nothing to be concerned about. Most pre-qualifications are good up to 90 days, and due to Regulation Z, the Truth in Lending Act, Homebuyers can shop around with several mortgage brokers to find the best possible rate on their home loan, as you will only receive one hard credit pull while you shop around for the best rates available. In order to qualify for a mortgage, most lenders will want your debt-to-income ratio to be under 43%. A higher down payment will typically afford you a better interest rate, however, downpayment requirements vary between lenders and generally go as low as 0% down for VA or Veteran loans, 3.5% for FHA loans, and 5% down for conventional loans.

While FHA loans usually require a monthly Mortgage Insurance Premium (MIP) payment for the life of the loan, conventional loans require a monthly Private Mortgage Insurance (PMI) payment up until you reach 20% equity in the property. PMI can be several hundreds-of-dollars monthly but can be avoided by purchasing a property with 20% down. There are also state, county, and municipal grants to cover down payments for first-time Buyers and low-income applicants. A little searching on your part as a Homebuyer is necessary in order to find such available programs to apply for and meet each locality’s specific requirements. Please note that during competitive, Seller markets offers contingent to down payment assistance from these grants will be less competitive and take longer to close than offers not subject to these funds.

If you’re looking for investment properties to flip and interested in short-term financing with hard money lenders, or cash-out refinancing, please give me a call. I can help finance FICO scores as low as 500 and have 100% LTV programs available, as well as appraisal-waived financing.

Alternatively, if you are interested in the Welcome Home Instant Cash Buyer program, where I can turn any pre-qualified Buyer into a cash Buyer, ask me for more information!

How to Start Your Real Estate Search – While websites like Zillow, Realtor.com, and Redfin are useful tools for Homebuyers, they are merely entertainment websites. Many of their advertised listings are already under contract and inaccurately listed as available because they can advertise having more listings than their competitors and can refer more leads to Realtors this way. The best way to begin your real estate search is to speak with a licensed realtor with full access to the Multiple Listing Service (MLS) in your area, like me. These realtors pay dues to their associations to maintain the up-to-date, real-time accuracy of listings posted. Please contact me if you would like me to send you listings that fit your search criteria daily. During competitive Seller markets, it’s important to schedule showings within a few days of a listing being posted, so receiving newly posted listings daily is the best way to stay ahead of your competition.

Text me at 1.847.849.7748 or email me at ryan.widerberg@exprealty.

If you would like listings emailed to you daily, please fill out this Buyer’s Questionnaire. For up-to-date information on the newest listings in your area, far more accurate than Zillow or Redfin, please visit Welcome Home Search

What to Look for During Your Showings – During our showings, I’ll do my best to bring you a full list of the ages of the mechanicals, appliances, windows, and roof of the home to give you an idea as to when recent improvements have been made. Also, I will check in with listing agents to see if there are any offers on the table and if there’s an offer deadline. I’ll go over any applicable disclosures with you, such as the lead, radon, and real property disclosures, to ensure there are no known defects or problems with the property. If you’re interested in submitting an offer, it’s important you’ve emailed me a pre-qualification that’s no more than 90 days old. Also, I believe it’s best to email the Sellers a pre-qualification for the maximum amount you’re pre-qualified for.

In a competitive, Seller market where there are multiple offers, it’s best to lead with your best foot forward, showing a Seller you’re more than qualified to purchase their property which gives Sellers some reassurance your financing is less likely to fall through. Also, in the event of a multiple-offer situation, many Buyers tend to increase their original offers, submitting their highest and best to Sellers. Having a maximum pre-qualification from the beginning will put less stress on your Mortgage Broker to send us updated pre-qualifications for a higher amount within a short window of time.

When it comes to discussing the terms of your offer, I will email you comparative properties sold within the last 12 months to give you a crystal clear understanding of what properties in the neighborhood have sold for.

The Three Rounds of Negotiations – Most financed real estate transactions are made up of three rounds of negotiation. The first round of negotiation in most real estate transactions consists of an offer made on a multi-board contract for purchase with relevant terms including your purchase price, any Seller concessions requested, earnest money offered, financing type, down payment and interest rate percentages, closing date, inspection, and attorney review period, mortgage contingency date, tax proration percentage, whether or not your purchase is contingent upon the sale or close of another property, whether you agree to purchase as-is, request a home warranty, termite inspection or well and septic inspection from Sellers, option for the Sellers to leaseback, appraisal gap agreements, as well as several other more unusual requests. While these terms can seem complicated for Buyers, I’ll make sure to fully guide you through the process and answer every question you have. I will go over each of these terms in greater detail.

When writing up an offer in a competitive, Seller market there are a few terms we can alter for our offer to stand out above all others, especially for less desirable financing types to Sellers like FHA or VA loans. If we know we’re involved in a multiple-offer situation, one of the best ways to win is by writing an escalation clause into our offer. This is the best way to win without blindly overspending. These types of offers include a specific offer amount with an addendum announcing we will beat any viable offer by a certain buffer amount up to a maximum purchase price. This is the best way to win while putting a limit on your offer amount. Another useful strategy to win a property you anticipate will be receiving multiple offers and subsequently will be going well above the asking price is by writing an expiration date into your offer. This generally works best when an offer is submitted to Sellers between Monday and Thursday of the week the property is listed. The intention here is to avoid weekend showings when the most Buyer activity is likely to occur and to convince a Seller to sign a contract with you before a multiple-offer situation arises. Convincing a Seller to accept your offer with a deadline is best done by incentivizing them with an offer above their asking price.

During less competitive markets, Buyers have a better chance to win offers including Seller concessions. These funds can be used for the Buyer’s closing costs or simply be used as cash to furnish the property post-purchase. Earnest money is included in every real estate offer and is generally anywhere between 1% – 10% of the home’s purchase price and is to be delivered between 2 and 3 business days in the form of a cashier’s check or money order. These funds are usually held in an escrow account by either the Buyer or Seller’s real estate office, an attorney affiliated with the transaction, or the title company. Ultimately, the earnest money is applied toward a Buyer’s down payment amount at closing. In the event a Buyer chooses to cancel their real estate contract within the attorney review and inspection period, their earnest money will be refunded, however, if a Buyer breaks the terms of the contract and cancels after the attorney review and inspection period expires, they may risk losing their earnest money due to a breach of contract. The mortgage contingency date is the timeframe it takes a Homebuyer to secure a mortgage loan for a home. If the loan cannot be secured, the Buyer can walk away without legal repercussions and have their earnest money deposit returned. I have never represented a buyer who has lost their earnest money due to negligence, so you’ll be in great hands.

When there’s some anticipation of interest rates rising, and you know you’ll be purchasing a property, it’s a good idea to ask your mortgage professional to lock your interest rate to avoid paying a higher rate before closing. Locking an interest rate usually requires a rate lock extension payment if a closing date occurs past a certain date, so it’s important to lock your rate once you have reasonable certainty about when you’ll be closing on your purchase. While my preferred lender can close in as little as 10 days, conventional offers for purchase with Mortgage Bankers at banks or credit unions generally take around 30 days, while FHA and VA offers are 45 days on average. The standard attorney review and inspection contingency is five business days (not including Saturdays or Sundays), however, this period can be altered upon writing an offer. Generally speaking, property taxes are raised by roughly 5% annually. Because taxes are paid in arrears, we can assume they will be roughly 5% higher than the previous year’s tax bill. At the closing table, Sellers usually credit Buyers between 100%-110% of the current year’s tax amount to account for this increase.

In competitive, Seller markets, it is unlikely that a Seller will accept an offer made by a Buyer with a home sales contingency, which means that the Buyer has yet to receive a purchase contract on the current home they are required to close on before purchasing something new. If you plan on purchasing a property, yet have to close on your current home to close on a new one, it is much more likely to have a Seller accept your offer with a home close contingency, which means the home you have to close on before purchasing a new home is already under contract with a Buyer but has yet to close. The Seller of your new property is agreeing to take a risk with your offer, even though it is contingent on another party’s real estate transaction. In ultra-competitive markets where properties receive multiple offers, it is unlikely a Seller will accept an offer with a home sale or home close contingency, however, there are some strategies you can use to win in these types of scenarios. Buyers can even offer Sellers the option to lease back their home for an agreed-upon rental amount, which can certainly sway a Seller’s decision if their moving time frame doesn’t quite align with the market average of 30-45 days.

In less competitive Buyer’s markets, sometimes Buyers request Home Warranties paid for by Sellers. These policies cost between $400 – $1000 and generally last between 12 to 18 months after closing and warrant a range of things inside the home for that period, including appliances, mechanicals, plumbing, electrical and other fixtures within the home. Here is a home warranty partner company I recommend: America’s Preferred Home Warranty

The second round of negotiations in most real estate transactions comes after a Buyer conducts their inspections on the property. Inspections you may want to conduct during this period include a professional home inspection, radon, sewer, well, and septic inspections, termite, roof, mold, and asbestos inspections, or anything else you’re concerned about before closing. Most professional home inspections are between $300 – $700 and generally include a home inspection report of between 50 and 200 pages, including every flaw the inspector could find with the property. Once this report is received, Buyers have the option to request Sellers fix these issues, issue a credit for the issues, or a combination of repairs and credits. This is the second round of negotiations. As-Is transactions are considered more competitive offers because they essentially in theory eliminate this round of negotiations.

Additionally, if you plan on having anyone sleep in a basement space, radon inspections are encouraged. If results come back too high, Buyers can request the Sellers install a radon remediation system. I find that most Sellers will agree to this because alternatively they’ll be required by law to disclose high radon levels to any future Buyers within their radon disclosure. If the building has older pipes, you may want to have a plumber do a sewer scope to ensure there are no problematic clogs. If a home inspector finds what appears to be mold, you can hire a mold remediation expert to test the area to determine whether it is in fact mold, and request the Sellers pay for remediation before closing. While these inspections are generally conducted within 5 business days of an accepted contract, extensions are usually granted and agreed upon by real estate attorneys. If there are any terms in the real estate contract that the Buyer or Seller requests be changed, this is best done during this 5 business day attorney review window. An amendment is sent out between attorneys and is signed by both Buyer and Seller’s attorneys to conclude this second round of negotiations.

The third round of negotiations in most real estate transactions is brought forth after the results of the property appraisal. A representative from the financial institution is sent to evaluate what they determine the free market value of the property is, usually based on comparative properties in the neighborhood. If the appraiser determines that the property is worth more than the contract price, it can be assumed that the purchaser has instant equity in the property. If the property appraises for the contract price, there is no problem, and no third round of negotiations, however, if a property appraises for less than the contract price, there is a problem that can be remedied in one of three ways. In less competitive Buyer markets, the Seller may agree to reduce the contract price to the appraised amount. In more competitive, Seller markets with multiple offers, the Seller may request that the Buyer brings the difference between the contract price and appraised amount to closing in the form of extra cash at closing. Lastly, the Buyer and Seller can negotiate this gap between the contract and appraisal amounts, each making concessions to pay for the difference.

When it comes to financing types, cash is king, conventional is 2nd best, followed by VA and FHA loans. Cash offers don’t require appraisals and are considered more competitive offers because this third round of negotiations is never an issue. During ultra-competitive markets, Buyers will sometimes agree to appraisal gap agreements. Appraisal gap agreements are a great way to convince a Seller to agree to your offer with less ideal financing or less favorable contingencies, guaranteeing the Seller a certain amount above what the property appraises at, in the event of an appraisal issue, which gives a Seller more confidence in your ability to close the transactions.

Please give me a call with any questions about real estate contracts or associated terminology. I’d love to help you better understand how to win in a competitive real estate market.

Now That You’re Under Contract – Congratulations on your accepted offer! Now that we’re officially under contract, you are one step closer to homeownership! Because both Buyer and Seller have signed this contract, we have officially begun the Attorney Review and Inspection period, which is generally a 5 business day period you’re entitled to conduct any inspections you wish. My preferred real estate attorney’s contact info is listed in the description below. While you are entitled to use any attorney of your choosing, I highly recommend you use one who specializes in real estate. Most buy-side attorneys charge around $400-$650. Please let me know which attorney you’ll be using for your transaction so I can immediately email the executed contract to your preferred attorney and mortgage broker.

Also, if you plan on conducting a home inspection, you can see my preferred home inspector’s information in the description below. Please let me know which home inspector you will be using. Depending on the property type, home inspections can range between $300-$700. Now that we’re under contract, it’s best that you call both the attorney and home inspector handling your transaction so you can discuss what their fees are. Also, please schedule a home inspection as soon as possible, taking place no later than 2-3 days after your accepted contract. This will ensure our attorney has enough time to write their attorney review letter to the Seller’s attorney. It’s important you attend the home inspection, which will take anywhere between 1-3 hours, where your inspector will go over any major issues they find with the property.

The second round of negotiations in most real estate transactions comes after a Buyer conducts their inspections on a property. Inspections you may want to conduct during this period include a professional home inspection, radon, sewer, well, and septic inspections, termite, roof, mold, and asbestos inspections, or anything else you’re concerned about before closing. Most professional home inspections include a home inspection report between 50 and 200 pages, including every flaw the inspector could find with the property. Once this report is received, Buyers have the option to request Sellers fix these issues, issue a credit for the issues, or a combination of repairs and credits. This is the second round of negotiations. Additionally, if you plan on having anyone sleep in a basement space, radon inspections are encouraged. If results come back too high, Buyers can request the Sellers install a radon remediation system. I find that most Sellers will agree to this because alternatively they’ll be required by law to disclose high radon levels to any future Buyers within their radon disclosure. If the building has older pipes, you may want to have a plumber do a sewer scope to ensure there are no problematic clogs. If a home inspector finds what appears to be mold, you can hire a mold remediation expert to test the area to determine whether it is in fact mold, and request the Sellers pay for remediation before closing. While these inspections are generally conducted within 5 business days of an accepted contract, extensions are usually granted and agreed upon by real estate attorneys. If there are any terms in the real estate contract that the Buyer or Seller requests be changed, this is best done during this 5 business day attorney review window. An amendment is sent out between attorneys and is signed by both Buyer and Seller’s attorneys to conclude this second round of negotiations.

If the Buyer and Seller do not come to terms with inspection requests or attorney review modifications, this would be the best time to cancel your contract to avoid risking the loss of your earnest money.

Here are a few Real Estate Attorneys I recommend:

Justin Abdilla & Associates

650 Warrenville Rd. #100

Lisle IL 60532

Phone: 630-839-9195

Fax: 630-454-3530

www.abdillalaw.com

Website Address: https://www.

Here are a few Home Inspectors I recommend:

Shawn Santos

Optimal Home Inspections LLC

optimalhomeil@gmail.com

773-710-5891

Tim Mueller

On The Level Home Inspections

(630) 567-5757

Let’s Review Your Home Inspection Report – Now that I’ve reviewed your home inspection report, I wanted to touch base with you to discuss it. While the report may seem overwhelmingly long to you, most home inspection reports run between 50 – 200 pages. It is not unusual for your home inspector to include everything they can possibly find an issue with, however, there’s no need to be overly concerned. In competitive markets, it may be worth moving forward without asking for any repairs or Seller concessions. During less competitive markets, it’s reasonable to ask Sellers to repair certain items, credit a Buyer instead of repairing items before closing, or a combination of repairs and credits. It is generally not reasonable to ask a Seller to repair every line item on a home inspection report unless the property is new construction. In general, you should not expect a Seller to agree to everything you ask them for. The attorney review process is a meeting of the minds and is the second negotiation phase in the real estate transaction.

Now That Attorney Review is Closed – Congratulations, we have officially come to terms with the second round of negotiations in our real estate transaction and have closed out our attorney review and inspection period! At this time, we are most likely still waiting on your financing to be officially approved in what’s called a clear to close. Your mortgage broker is required to send you an initial closing disclosure within 3 days of you submitting your mortgage application, so you should already have a rough estimate of what your closing costs will be. If not, please reach out to your mortgage professional.

At this stage in our real estate transaction, we are most likely still awaiting the results of the appraisal. The third round of negotiations in most real estate transactions is brought forth after the results of the property appraisal. A representative from the financial institution is sent to evaluate what they determine the free market value of the property is, usually based on comparative properties in the neighborhood. If the appraiser determines that the property is worth more than the contract price, it can be assumed that the purchaser has instant equity in the property. If the property appraises for the contract price, there is no problem, and no third round of negotiations, however, if a property appraises for less than the contract price, there is a problem that can be remedied one of three ways. In less competitive Buyer markets, the Seller may agree to reduce the contract price to the appraised amount. In more competitive, Seller markets with multiple offers, the Seller may request that the Buyer brings the difference between the contract price and appraised amount to closing in the form of extra cash at closing. Lastly, the Buyer and Seller can negotiate this gap between the contract and appraisal amounts, each making concessions to pay for the difference.

In the meantime, let’s cross our fingers the property appraises! While your mortgage broker is submitting the final figures to the underwriting department, it is not unusual for our anticipated closing date to be delayed slightly. Unfortunately, there are a lot of moving parts to each transaction and roughly 35% of real estate transactions end up being delayed for one reason or another but don’t worry, I’ll do my best to ensure we cross the finish line!

If you’ll be out of town or prefer not to attend your closing at the title company and pre-sign the documents instead, this can be done by signing a power of attorney with your real estate attorney, however, it’s best you notify your attorney no less than two weeks before the anticipated closing date so they can prepare the power of attorney and documents.

Now That We Have a Clear to Close – Congratulations! We have officially received a clear to close on your mortgage! Now that we are past all three rounds of negotiation for this transaction, all that’s left is for your mortgage professional to send you a final closing disclosure. Depending on when we’ve received your clear to close and when your anticipated closing date is, TRID regulations require your final mortgage closing disclosure to be delivered to you no less than 3 days before closing, which might push back your closing date. As long as you’ve received this final disclosure three days before our anticipated closing date, there should be no problem, however, ultimately both Buyers’ and Sellers’ attorneys will have to agree upon a date they can sit down together at the title company to hash out the paperwork.

Either the day before or the day of closing, my Buyers and I will schedule a Final Walkthrough at the property. I’ve already prearranged to make sure the Seller is fully moved out of the property and has left any applicable appliance manuals, extra sets of keys, and remote garage transmitters on the kitchen counter for you. During the final walkthrough, we will ensure that all of the real property included in the contract is still inside the property, and will check to make sure any requested repairs have been completed. If there is any damage that’s been made to the property from moving out or any repairs that have not been completed, we have the option to report these issues to our real estate attorney to pass on to the Seller’s attorney. Usually overestimating the cost of the repairs, we can request money be held back from Sellers in an escrow account until the requested repairs are completed by licensed professionals or instead request a credit from the Sellers at the closing table. In the event Buyer and Sellers cannot come to terms on a mutually agreed solution, Buyers have the option to walk away at the closing table due to a breach of contract. Don’t worry. Your attorney and I will do our best to ensure a smooth closing. The closing should take between 1-3 hours. Once we’re officially closed, I’ll make sure your keys are delivered to you to access the property, however, I do recommend rekeying your new home, as you never know who may have access to a key.

Congratulations on Your Closing – Congratulations on your closing! I hope it went smoothly. As you’re probably aware, the real estate industry is highly competitive and I want to thank you from the bottom of my heart for your business. Choosing me as your industry professional means a lot to me and my family. If you know anyone interested in buying or selling real estate, I would certainly appreciate your referrals! I will always do my best to ensure your friends and family get top-notch service and would be honored to represent them as their real estate professional. If it’s not too much to ask, would you mind reviewing my services on Realtor.com, Zillow, or Redfin? I’ve included links to review my services in the description below.

Don’t forget to apply for a homeowners exemption on your county’s tax bill. This can save you roughly $500 annually and will ensure your property is more marketable in the future.

If you’re interested in finding an all-inclusive utility provider, here is a link to help you with easy signup: Sign Up for Utilities Made Easy If you would like to order home security services, I have included a signup link for that as well. Hopefully, we get to work with each other again soon! Thank you very much, and I hope you enjoy your new home.

To help me better understand your real estate needs, please fill out this Buyer’s Questionnaire.

Change the Figures Highlighted in Red to Calculate Cash on Cash & Cap Rate for Investors

Please enter your username or email address. You will receive a link to create a new password via email.